Stern Ventures is an end-to-end investment bank dedicated to raising capital and brokering strategic partnerships from $5 to $300 million for technology and media companies.

Stern Ventures guides clients through the entire deal process from strategic planning to successful closing, with care and integrity. We add value for our clients by identifying and negotiating with the best qualified institutional partners and streamlining the due diligence process.

Stern Ventures leverages deep industry expertise and connections to help clients achieve their strategic objectives. Our network of over 36,060 capital decision makers and C-level executives forces investors to compete for your business.

"Who can I trust for capital

market advice?"

"How can I get the deal that’s right for me in front of targeted decision makers without wasting time?"

"What are the common

mistakes I should avoid?"

BOB WALTERS

BOB WALTERS

At the time we engaged Stern Ventures, we were in the midst of a complicated and scary acquisition, our third in nine months. We needed ‘strategic development’ help -- analysis, sourcing, and deal management.

Stern Ventures was like manna from above in this context and he immediately dove in and virtually ran the deal to completion.

*Testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

Stern Ventures, through Rainmaker Securities, LLC., a registered broker-dealer, offers the following services:

If you’re a CEO, CFO, or COO with strategic initiatives requiring significant investment capital to grow your business, Stern Ventures links you with our network of over 6,750 financial institutions.

By getting the right offer in front of multiple decision makers, we help our clients identify and arrange equity and debt financing between $5 million and $300 million for expansion, acquisitions, or recapitalization.

With C-level contacts at 12,900 domestic and 16,410 international corporate development departments, Stern Ventures facilitates your optimal M&A exit.

Whether you’re in the information technology, media, telecom, or mobile sector, we specialize in both sell-side and buy-side M&A guiding you through the entire process. By leveraging our contacts in a competitive atmosphere, you get the most from your current holdings and avoid the risk of leaving “money on the table.”

For buyouts, Stern Ventures helps LBO/MBO sponsor and debt investors craft a financing structure that meets your investment objectives ... as well as those of your stakeholders.

We listen and reflect our clients’ need for a strategic plan that provides targets with financial flexibility to operate and grow your business post buyout.

If your existing shareholders are looking to sell their equity, Stern Ventures provides a 6-9 month liquidity process ... without having to wait for an IPO or M&A event.

By facilitating secondary offerings, Stern Ventures enables exiting shareholders to monetize illiquid holdings while your company’s current capital structure stays in place.

Developing your business through both downstream and upstream partners can take many forms: expanding distribution, engaging new suppliers or channels, creating complementary product offerings, or finding opportunities to license, package, and sell your current services.

As a client, you can leverage “Stern Ventures’ broad network” to develop powerful strategic partnerships with C-level executives in companies who share your same growth objectives.

Preston Rohrick,

Preston Rohrick,I connected with Stern Ventures through my contacts while looking to raise our Series A.

The Team looked over our documentation, had a couple of one on one phone meetings, prepared a long list of questions, and then analysed our business plans, decks and materials.

Stern Ventures got back to us with a long list of recommendations and potential changes to help us better present our company to VC's. They helped us simplify the message and more precisely highlight our product and the opportunity.

Stern Ventures ripped it apart, and gave us clear suggestions and improvements.

*Testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

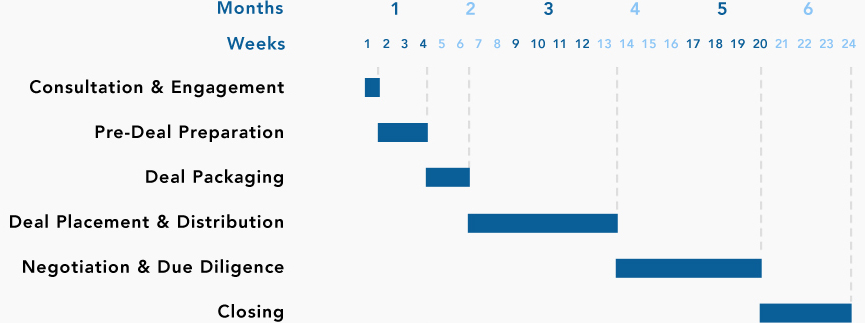

All Stern Venture engagements start with an initial 20-minute consultation focused on you and your strategic goals. A typical capital raising or M&A cycle takes 6 to 9 months.

Consultation

& Engagement

Define your strategic objective

Determine your capital needs

Execute engagement agreement

Pre-Deal

Preparation

Conduct advisor due diligence

Develop and present strategic plan

Meet with stakeholders

Perform valuation analysis

Deal Packaging

Confidential Information Memorandums (CIM)

Complete Business Plan

Targeted Teasers & Pitches

Organize financial statements

Set up supporting documents

Deal Placement

& Distribution

Identify 150+ investment partners

Focus on qualified investors

Execute NDA’s

Deal tracking and weekly updates

Identify and pitch to select investors

Private Road Show

Negotiation

& Due Diligence

Secure letter of intent

Evaluate term sheets

Conduct investor due diligence

Control and monitor digital data

Foster "competitive tension" among bidders

Closing Documents

& Transaction

Select Leading Investor

Finalize Definitive Agreement

Obtain final approvals

Coordinate legal advising

Close transaction

Distribute funds

The chart below highlights the schedule for a 6 month deal process.

Stern Ventures values our clients’ integrity and time. Thus we offer the most favorable terms to all of our clients based on our 5-5-5 deal structure.

Acquisition Targeting

Asset Sales

Business Combination

Business Development

Best Effort Underwriting

Confidential Information Memorandums (CIMs)

Contract & Closing Negotiation

Coordinate Legal Services

Corporate Development

Deal Sourcing

Divestitures

Exit Strategy

Fairness Opinion & Business Valuation

Foster Competitive Tension

Identify & Select Investment Banks

Leveraged & Management Buyouts

Mergers & Acquisitions: Buy and Sell Sides

Private Placement

Private Road Show

Reorganizations

Restructuring

Shareholder Liquidity

Strategic Planning

Venture Capital

Stern Ventures is an end-to-end investment bank serving technology companies with strong fundamentals.

As our client, we guide you through the entire deal-making process from strategic planning to successful closing.

Access over 36,060 financial and corporate development departments through our active network of strategic contacts, managing directors, and C-level executives.

Our deep insights into each of your prospective partner’s tastes and preferences enable you to connect with multiple partners and target the "sweet spot" for specific institutions. This includes offering you a brief synopsis of each company’s:

Managing Partner

Mr. Quach, a registered representative of Rainmaker Securities, LLC., is the Founder & Managing Partner of Stern Ventures. Previously, Mr. Quach served as the VP of Finance & Strategy at Untangle, Inc. where he spearheaded the company’s acquisition growth strategy, doubling the size of the parent company.

As part of the Technology Investment Banking Group at Morgan Joseph TriArtisan, Mr. Quach sourced and executed equity, debt, and M&A transactions representing over $250 million in aggregate value.

A co-founder of two startups in the digital publishing and display sectors - Emiscape & Magmazines - Cang holds five U.S. utility patents.

Prior to these ventures, Mr. Quach served as an Equity Research Associate at Dodge & Cox, an investment management firm with over $200 billion in AUM, where he analyzed companies in the cellular, automotive, and retail sectors.

He also served as an economic analyst at the Economic and Social Council (ECOSOC) of the United Nations in New York.

MBA from U.C. Berkeley’s Walter A. Haas School of Business BA in Economics with Honors (Phi Beta Kappa) from Occidental College

CFA Charterholder FINRA Series 7, 24, 62, 63, & 79 Licenses

With an over $500 million track-record of success, here’s exactly why Stern Ventures is a trusted advisor in the investment banking industry.

Syndicated private placement for Green Biologics (Biotech, Cleantech) from Sofinnova Partners (European VC) and Swire Pacific (Global Conglomerate).

Private placement for Yellowpepper (Mobile Payment) by Latin Idea Ventures (Latam VC).

Syndicated private placement for Advanced Data Center (Data Center).

Total Defense (Consumer Security Software) with Untangle Inc. (Network Security Software).

LocalBizNOW (Digital Media) by MDC Partners (AdTech Holding Company).

VICE PRESIDENT

Ms. Wang, a registered representative of Rainmaker Securities, LLC. and VP at Stern Ventures, has over 10 years and $200+ million in M&A experience. Previously, Ms. Wang served as Senior Manager of Corporate Development at EFI, Inc., where she helped develop and execute the Company’s acquisition growth strategy.

During her tenure, Ms. Wang successfully managed and closed numerous M&A transactions, representing over $100 million in aggregate value. Her efforts enabled EFI’s target of $1 billion revenue in 2016.

As part of the Wells Fargo Corporate Development team, Ms. Wang executed strategic acquisitions of asset-backed loan portfolios and aircraft leasing JV’s, representing over $110 million in transaction value.

Prior to, Ms. Wang was part of the Wells Fargo Corporate FP&A group, focusing on forecasting, budgeting and analysis for the Wholesale Commercial Banking division. She was instrumental in the post-merger integration of the Wachovia Bank acquisition, as well as in the implementation of key company-wide finance initiatives.

M.S. Financial Engineering from Columbia University B.S in Electrical Engineering from University of California, Los Angeles

FINRA Series 79 & 63 Licenses

VICE PRESIDENT

Mr. Flynn, a registered representative of Rainmaker Securities, LLC. and VP at Stern Ventures, spent 4 years living and conducting business in Beijing, China. While in China, he successfully founded, grew, and exited a profitable education company. Shawn moved back to San Francisco to invest his experience, connections, and resources back into the startup ecosystem.

Mr. Flynn works with incubators, accelerators, angel groups, VCs, local governments, and institutions to promote economic growth. He helped multi-national companies set up operations in Silicon Valley while connecting prominent Silicon Valley companies with strategic and funding relationships overseas.

As the founder of the TV show Silicon Valley Successes, Mr. Flynn hosts the Podcast “Silicon Valley” on the Investor Podcast Network. He is passionate about building bridges that connect Silicon Valley to the rest of the world.

Bachelors of Science in Mechanical Engineering from U.C. San Diego

FINRA Series SIE, 7, 63, & 79 Licenses

Our network ... and your success

Our robust network of 36,060 managing and C-level connections means that your prospective partners aren’t just pre-qualified, but will actually compete for your business.

The right experience ...

to determine your optimal financial

needs.

The right commitment ...

to dedicate ourselves to your best

interests.

The right connections ...

to deliver competitive results that

help you succeed.

For an in depth look at our Transaction Experience, you can read more on our Who We Are page.

Connect directly with Stern Ventures today and secure your initial consultation focused on

defining your own strategic initiatives and business goals.

415-309-8987

4 Embarcadero, Suite 1400

San Francisco, CA 94111